Catalysis

Millions of Euros

Revenues for Catalysis increased 9%, benefiting primarily from the integration of Haldor Topsoe’s heavy-duty diesel and stationary emission control catalyst activities, as well as from higher demand for Umicore’s gasoline catalyst technologies. Recurring EBIT increased 2% with volume growth partly offset by the less favorable engine mix in Europe. The ROCE for Catalysis included some anticipated temporary dilution effect owing to recent acquisitions that have yet to deliver their full synergy potential. New capacity will come on stream in China, Europe and India towards the end of 2019 to accommodate for recent platform wins compliant with new legislations.

Revenues for Automotive Catalysts were higher, driven by an increased contribution from the heavyduty diesel catalyst activity and higher demand for Umicore’s gasoline catalyst technologies.

Millions of Euros

Umicore has won the largest share of new gasoline platforms requiring particulate filters in Europe and China and is becoming the global leader in this segment.

Considering the growing share of gasoline engines in the mix, Umicore is best positioned to benefit from the unprecedented value growth of the car catalyst market.

Umicore recorded higher car catalyst sales volumes year on year, reflecting its strong position in gasoline applications and despite the fast-declining sales of diesel cars in Europe. Global light-duty vehicle production contracted by 1.1% in 2018 reflecting the slowdown of the Chinese and European car markets in the second half of the year.

%

In Europe, demand for Umicore’s gasoline catalysts was strong particularly for direct injection engines, which require more complex catalyst systems under Euro 6d. To cater for this growing demand Umicore is expanding capacity at its Nowa Ruda plant in Poland. The additional production lines are due to come on stream in the second half of 2019. Revenues were impacted by the decline in diesel car production and, to a lesser extent, customer platform delays in the second half of the year caused by the introduction of the new WLTP testing regime. In North America, Umicore’s revenues increased despite a declining car market. Umicore benefitted from a good platform mix, with an increased exposure to the popular SUV segment, as well as customer wins. Umicore’s volumes were substantially higher in South America, in line with the recovering car market.

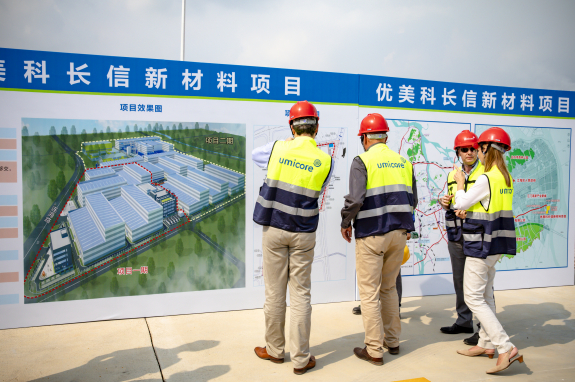

Umicore recorded higher revenues in China where its customers outgrew the market. This strong performance was in sharp contrast with the evolution of the Chinese car market, which contracted in the second half of the year. Moreover, Umicore has won additional awards for China 6a and b compliant platforms. To cater for these awards, Umicore is substantially increasing its catalyst production capacity in China with the new lines set to come on stream at the end of 2019.

Umicore successfully expanded its market share with Japanese OEMs globally, while in Korea, revenues were flat in a slightly declining market. Umicore outpaced the South Asian market supported by the ongoing ramp-up of production in its new facility in Thailand. In India, Umicore won new Bharat Stage 6 awards, for which new production capacity will come on stream in the course of 2019.

The heavy-duty diesel segment benefitted from the integration of Haldor Topsoe’s heavy-duty diesel and stationary emission control catalyst activities.

This acquisition enabled us to broaden our technology portfolio, extend our customer base in Europe and China and expand our production footprint.

Umicore is now better positioned to capture the future growth of the global heavy-duty market, which is set to more than double in value by 2025 (compared with 2017) driven by more stringent legislation in key regions.

In Precious Metals Chemistry, revenues from fuel cell catalysts used in the transportation segment increased, benefiting from a first uptake of fuel cell drivetrain technology as an environmentally friendly alternative to internal combustion engines both for passenger cars and heavy-duty applications. Umicore has a complete and competitive portfolio of catalyst technologies for fuel cells and has entered into close collaboration agreements with leading OEMs for existing car platforms as well as future development programs.

In order to support the growth of our customers, we are expanding our fuel cell catalyst production capacity in Korea, as announced in December 2018. The new plant will be commissioned towards the end of 2019 and production will ramp up in 2020.

The expansion underlines Umicore’s unparalleled position in clean mobility materials as the only company worldwide offering at commercial scale the full spectrum of materials technologies required to enable the transition to cleaner mobility.

Alongside fuel cell catalysts, higher sales of active pharmaceutical ingredients and products used in chemical metal deposition applications contributed to the overall year-on-year growth of the business unit revenues.