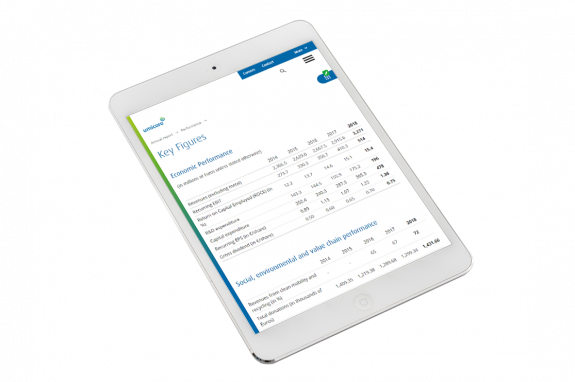

Driving economic performance

In 2018 we reached the horizon 2020 economic performance targets two years ahead of schedule and reaffirmed the upside potential.

Millions of Euros

We have selected 3 key performance indicators (KPI) to measure our success in the execution of our Horizon 2020 growth strategy and our progress towards our longer-term targets and objectives:

- Recurring EBITDA: This KPI gives a clear indication on earnings and profitability, and is also a good proxy for generated operating cashflows (cashflow from operations before change in cash working capital).

- Recurring EBIT: As part of our Horizon 2020 strategy we had set a 2020 recurring EBIT target of doubling the 2014 figure.

- ROCE: We want our investments to create value by generating attractive returns and have set a Group ROCE target of 15%+.

Millions of Euros

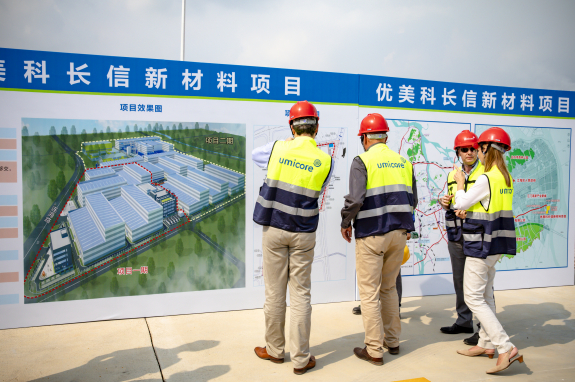

Umicore is delivering on its strategy to be the undisputed leader in clean mobility materials and recycling, with its offering of product and process technologies, combined with its closed loop approach and sustainable supply. As part of this strategy, we have won significant new business in the latter half of 2018, which will accelerate our growth in the coming years. For instance, in Automotive Catalysts, Umicore won the largest share of the gasoline platforms requiring particulate filters in Europe and China. In Rechargeable Battery Materials Umicore continued to secure major xEV platforms with OEMs globally.

We have delivered consistent recurring EBITDA increase since 2014, the reference year for our Horizon 2020 strategy and this despite the divestments of 4 business units. In 2018, recurring EBITDA increased by 23% with growth across all three business groups.

%

The recurring EBIT of € 514 million in 2018 is above the original 2020 target, 2 years ahead of schedule.

Compared to the baseline of 2014, returns on capital employed have increased substantially and now apply to a much larger capital employed base, resulting in significant shareholder value creation.

In 2018, a period marked by intense investments, our Group ROCE increased to 15.4%, above our target, with all business groups continuing to create substantial shareholder value.

In addition, we continued to step up our R&D efforts, which is reflected in a 56% increase in the number of patent family filings compared to the previous year.